Financing

Flexible Financing Solutions to Accelerate Your Growth

A set of financial tools to help you perform better

Leasing

Leasing is an innovative financing solution that lets you rent the equipment you need for your business, with the option of buying it at a later date.

This facilitates access to cutting-edge technologies and specialized equipment without tying up your capital.

With leasing, you benefit from predictable monthly payments that are often tax-deductible, offering more flexible financial planning and significant tax advantages.

This financing method is ideal for maintaining robust cash flow while supporting the development and growth of your business.

Refinancing

Equipment refinancing transforms the net value of your assets into immediate liquidity, revitalizing your cash flow for strategic investments in your business.

This flexible financial strategy enables you to extend amortization periods and optimize payment terms, making it easier to expand and strengthen your operations without compromising your existing assets.

Take advantage of tailor-made solutions that give your working capital a breath of fresh air, while benefiting from significant tax advantages.

Factoring - Accounts receivable

Factoring effectively transforms your invoices into direct cash flow, giving your business an immediate financial boost.

This process simplifies cash management by converting accounts receivable, both domestic and international, into available funds without waiting for customer payments.

Ideal for maintaining operational liquidity, factoring accelerates the revenue cycle and enables you to seize new business opportunities without the traditional liquidity constraints.

Business loan (Working capital)

A business loan, or working capital loan, is crucial for securing the liquidity you need to run and grow your business.

It provides the financial resources needed to cover short-term operating expenses, such as salaries, equipment purchases or short-term debts.

This financial tool plays a pivotal role in maintaining a healthy cash position, enabling your company to navigate nimbly through market fluctuations and seize opportunities without delay.

testimonials

My name is Adam

As a renowned commercial equipment finance broker, seasoned entrepreneur, investor and expert consultant, my career path is rooted in in-depth market knowledge.

With over a decade of experience in heavy equipment sales, enriched by a solid background in forest engineering and an entrepreneurial career, I have a unique understanding of the financial issues you face.

My expertise spans various sectors, including construction, transportation, forestry, industrial, medical and dental equipment. My ability to precisely identify your needs and efficiently structure your financing package makes me the ideal ally to support you in your strategic acquisitions.

Entrust me with your projects, and together we’ll take the next step towards your company’s success.

The benefits of working with me

25+ lenders in one place

Approval in 24 to 48 hours

Quick and easy

I'm sharing my experience with you

Frequently asked questions

Why choose me as your broker?

I negotiate advantageous conditions thanks to my unique partnerships in the sector, aimed at saving you time and money.

What equipment are you financing?

I finance a wide range of equipment in construction, transportation, forestry, and more. See my website for the complete list.

What financing solutions do you offer?

I offer leasing, conditional sales, factoring and refinancing, tailored to your needs.

How long does it take to get financing approved?

Fast and efficient, approval can be obtained in as little as 24 hours.

Can I finance used equipment?

Absolutely, used equipment financing is one of my flexible solutions.

Is my company's credit an obstacle?

I strive to find solutions for all financial situations, focusing on opportunities rather than obstacles.

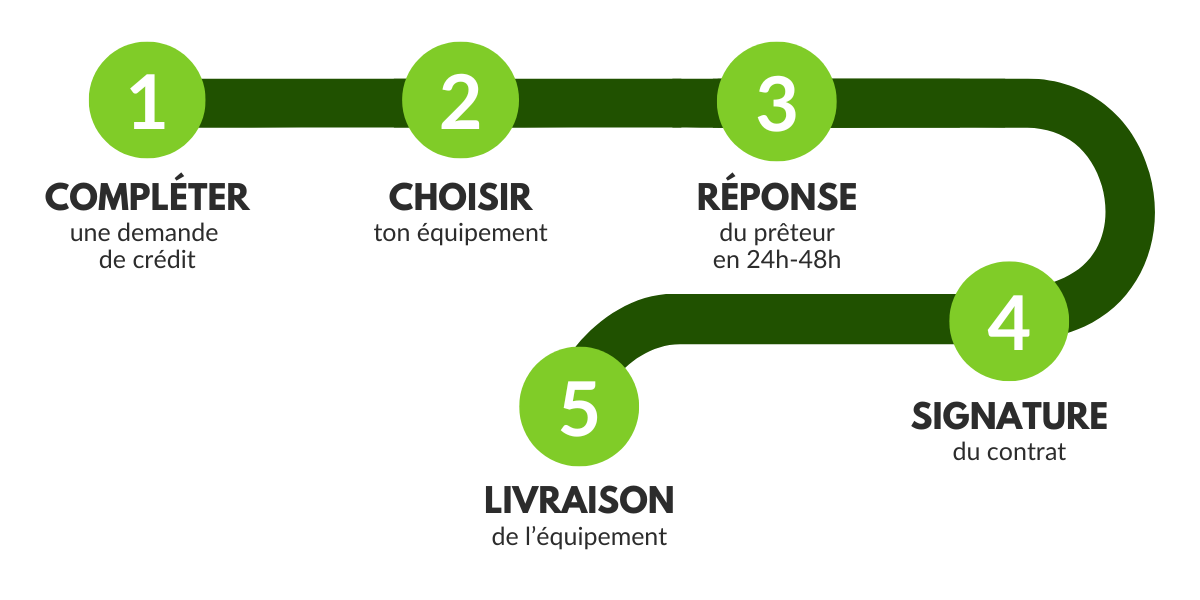

How do I start the financing process?

It’s easy: Contact me directly for a no-obligation initial consultation. We’ll discuss your needs and explore your options.